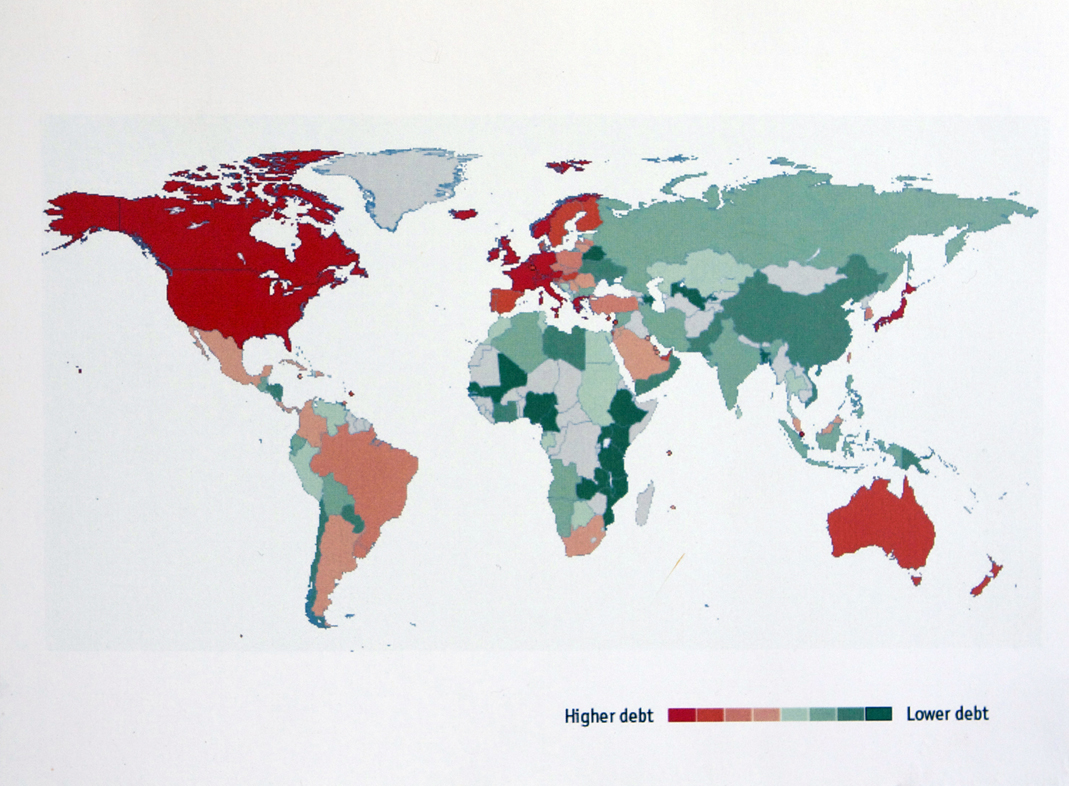

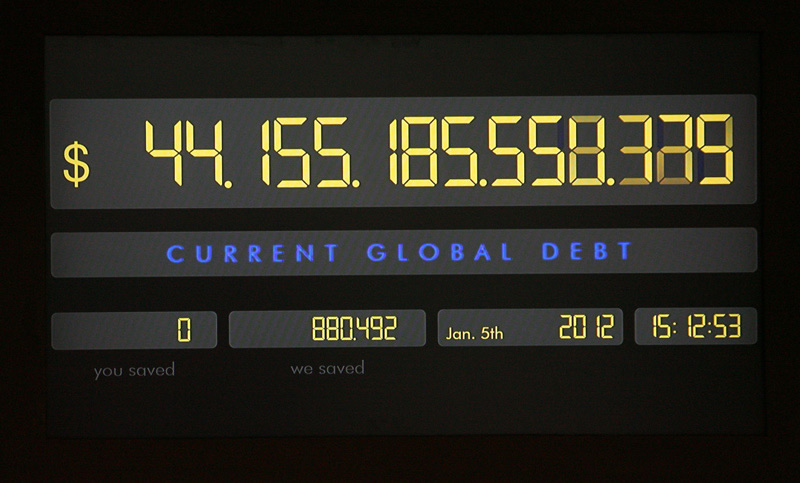

Global Debt Interactive Installation, 2011 Global Debt is an interactive work in which a screen is affected by a pedal. On the screen you can see a thirteen-digit umber that reflects the current growth of global debt, rapidly increasing from second to second – so fast, in fact, that it is not possible to decipher the last 6 digits. These numbers are based on real statistical data about world-wide debt, harvested from the internet and other publicly available financial sources. A pedal rests on the red carpet. By pressing on the brake-pedal with your foot, you can stop the global debt from rising, untill you let it go. On the screen you can see how much debt you saved, and how many millions of dollars was saved that day by all the visitors together.

|

At the directly material level of social totality, debts are in a way irrelevant, even nonexistent in light of the fact that mankind uses up as much as is at hand- by definition no one can consume more than that. We can talk about debt if we are considering natural resources (the destruction of material provisions for the survival of following generations). In that sense we are indebted to following generations, which literally do not yet exist and which, not without irony, will begin to exist only through us- and with this become indebted for their existence. Here as well, the expression “debt” does not have a literal meaning; it cannot be reckoned financially or quantified in measures of money. Debt makes itself known when some group (nation or whoever) within global capitalism expends more than it produces, which means another group consumes less than it produces- but the relationships are not so simple and clear-cut as they may seem. The relationships would be clear if there were to be a neutral instrument within the debt situation, an instrument which would measure how much more one group consumes compared to how much it produces, and at the expense of whom- the reality of the situation is far from this. According to the statistics which are available to us, more than 90 percent of money circulating is credit; if genuine producers find themselves in the position of being indebted to a financial institution, we can have doubts about the status of their indebtedness. How much of this is the result of speculation inside spheres having nothing to do with the local production unit? Here we can take Iceland as an example, where they voted to simply refuse to have the state cover the losses of private banks. When a country finds itself under pressure by international financial institutions, whether it be the IMF or private banks, we need to keep in mind that this pressure (which manisfests itself in the form of demands: cut public spending, open markets, deregulate banks) is not a reflection of some neutral objective logic or discourse, but of special-interest discourse: it is about a discourse which is formally embodied by a series of neoliberal premises, and which at the content level privileges the interests of certain countries and institutions. (Interview with Slavoj Žižek,DELO, 2nd March 2013) |